Start selling confidently with PayPal’s Seller Protection program

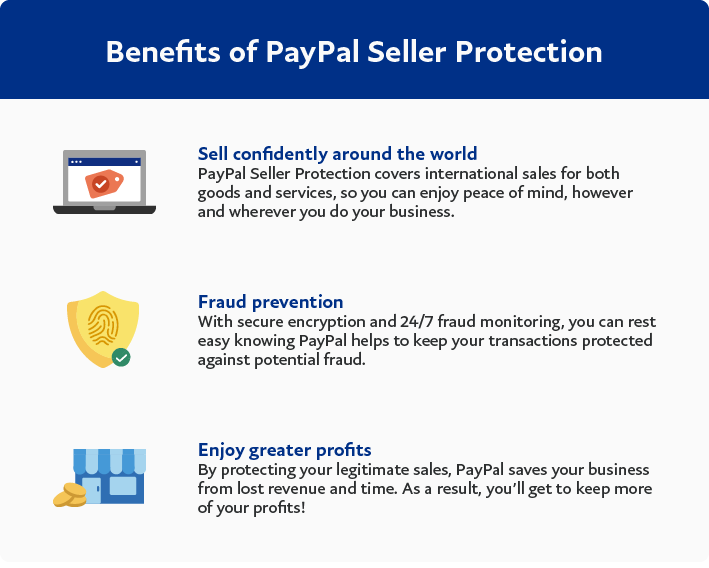

Worried about unauthorized payments or fraudulent claims affecting your bottom line? Discover how PayPal’s Seller Protection program can protect your sales be it physical or digital goods as well as services.

Selling online can be a challenge and can come with risks that may put a dent in your profitability. These risks can include unauthorized transactions claims - when buyers claim that they did not authorize the funds sent from their PayPal account. In other cases, there may be claims from buyers that they did not receive the item they paid for. These claims must then be borne by the seller.

These risks shouldn’t impact your bottom line, and that’s where PayPal’s Seller Protection program can come in handy to safeguard your transactions, so you can continue growing your profits with peace of mind. Read on to discover everything you need to know about PayPal’s Seller Protection program – from which eligible transactions are covered to how to claim refunds for eligible transactions under PayPal’s Seller Protection program.

What is PayPal’s Seller Protection program?

PayPal’s Seller Protection program is a program that can protects your business and eligible sales from potential loss due to chargebacks, disputes, payment reversals, unauthorized transactions, and fraudulent claims. Merchants who are eligible for PayPal’s Seller Protection program will receive a full refund on the eligible amount from PayPal. There are no limits to the number of payments that PayPal protects, if you meet the eligibility requirements.

What payment types does PayPal’s Seller Protection program cover?

Merchants who accept payment via PayPal’s Branded Checkout feature enjoy Seller Protection program where the transaction is marked as “eligible” on the Transaction Details page.

After 11 December 2024, PayPal’s Seller Protection program may also cover claims for “Unauthorised Transactions” for payments processed through PayPal Branded Guest Checkout, including basic debit and credit card payments, for all sellers (except for sellers with accounts registered in Singapore, China, Hong Kong, Australia).

How does PayPal’s Seller Protection program work?

Here’s how sellers can get reimbursed under PayPal’s Seller Protection program for eligible transactions.

- When a buyer files a claim or chargeback against your sale, we’ll place a temporary hold on the funds in your account.

- We’ll ask you to provide proof of shipment or delivery, generally within 10 days. This acts as evidence that the transaction was fulfilled, and we’ll use this information to determine if the sale is eligible for PayPal’s Seller Protection program.

- If the sale is eligible, we’ll release the held funds back into your account.

What does PayPal’s Seller Protection Program cover?

PayPal’s Seller Protection program covers two types of buyer complaints:

- Unauthorized Transaction

A payment was processed, but the buyer claims they didn’t authorize the transaction. - Item Not Received

The buyer purchased an item but claims through PayPal's Buyer Protection program that they didn’t receive it.

Here’s how you can prevent issues related to Unauthorized Transaction and Item Not Received complaints:

| Unauthorized Transaction | Item Not Received |

|

|

What is not covered under PayPal’s Seller Protection program?

Most PayPal transactions are covered under PayPal’s Seller Protection program as long as the eligibility requirements are met. However, here are some instances where PayPal’s Seller Protection program is not applicable:

- Payments equivalent to cash, including stored value items such as gift cards and pre-paid cards.

- Donations and personal payments sent using PayPal’s friends and family functionality.

- Payments for gambling, financial products or investments, gaming, and/or any other activities with an entry fee and a prize.

- Significantly Not as Described claims filed by the buyer (either with PayPal or the card issuer) where they receive an item that looks different or does not match the description of what they ordered.

- Item Not Received claims filed by your buyer directly with their card issuer.

- Tangible items delivered in person, unless the buyer paid for the transaction in person using PayPal’s goods and services QR code.

Please refer to our User Agreement for the full and most up to date terms.

View User Agreement

While Significantly Not as Described issues are not covered by PayPal’s Seller Protection program, there are steps you can take to lower your chances of running into them. Here’s how:

- Manage customers’ expectations by describing items accurately and in detail.

- Provide clear images of items from several angles.

- Clearly and accurately disclose any defects or damage.

- Answer queries promptly and clearly with a positive tone.

- Provide proof of authenticity, if available.

- Be open to resolving cases (such as returns, refunds, and exchanges as well as chargebacks, disputes, and claims) when they arise to prevent a formal complaint being filed against you.

What are considered eligible transactions?

Eligible transactions under PayPal’s Seller Protection program include both tangible and intangible goods as well as services that the buyer pays for with their PayPal account. For example:

- Tangible goods: apparel, electronics, toys.

- Intangible goods: digital products, event tickets.

- Services: transportation, business services, plumbing repairs.

Tip: For tangible items, it’s also important for sellers to ensure that the buyer has provided their shipping address as part of the transaction. The seller should then ship the item to this specific shipping address logged on the Transaction Details page in their PayPal account. This is critical because the proof of shipment must match the shipping address provided by the buyer in order for the transaction to be eligible for claims under PayPal’s Seller Protection program.

How do I claim for eligible transactions?

To claim your eligible transactions, follow this step-by-step guide:

- Log in to your PayPal Business account.

- Go to your Account Transaction Details page and check if the transaction is marked “eligible”.

- Promptly respond to our request for information, by providing proof of delivery or proof of shipment*, within the deadline given in the Resolution Center.

- While holding the payments temporarily, we’ll investigate the matter and confirm whether the transaction is eligible for PayPal’s Seller Protection program.

- Once confirmed, we’ll notify you and make the payments available to you.

*Additional requirements: For tangible goods, sellers must provide proof of delivery for Item Not Received issues. For Unauthorized Transaction issues, sellers must provide either proof of shipping or proof delivery. For intangible goods, sellers must provide proof of shipment or delivery.

What is proof of delivery or proof of shipment?

Proof of delivery refers to online or physical documentation from a shipping company that includes:

- The date of delivery and a “delivered” status of the item or service.

- The recipient’s name and address that matches what’s shown on the Transaction Details page.

- Signature confirmation or an online documentation that can be viewed at the shipping company’s website, indicating that the item was signed for on delivery.

Proof of delivery for intangible goods refers to any compelling evidence that proves that the purchase order was fulfilled, such as a system of record showing the date on which the item or service was provided, and that it was either:

- Electronically sent to the recipient, including the recipient’s address, where applicable; or

- Received or accessed by the recipient.

Meanwhile, proof of shipment refers to online or physical documentation from a shipping company that includes:

- The date of postage and a “shipped” status.

- The recipient’s name and address, that matches what’s shown on the Transaction Details page.

- The sender’s name and address must match the seller’s name and address.

- Online tracking information showing the status of the shipment.

Are there any fees associated with PayPal’s Seller Protection program?

There are no fees involved for PayPal’s Seller Protection program if you have a PayPal Business account. PayPal’s Seller Protection program automatically applies to your eligible sales when buyers pay you from their PayPal accounts. We want to make it easy for you to protect legitimate sales. So, if you fulfill the eligibility requirements, you can rest assured knowing that we have your back.

We understand how important it is to be able to sell online securely. PayPal’s Seller Protection program allows you to set up shop confidently by helping to protect your business from losses due to claims and chargebacks. Learn more about PayPal’s Seller Protection program here.