We’re your most connected payments partner

Our innovative, agile payments technology helps enterprise businesses grow safely and efficiently.

One platform with infinite possibilities

Secure

Our mix of transaction data, models as part of our fraud monitoring technology keeps you safe from risks

Efficient

Stay agile and ahead of trends with innovative payments technology that is modular, interoperable, and easy to integrate

Scalable

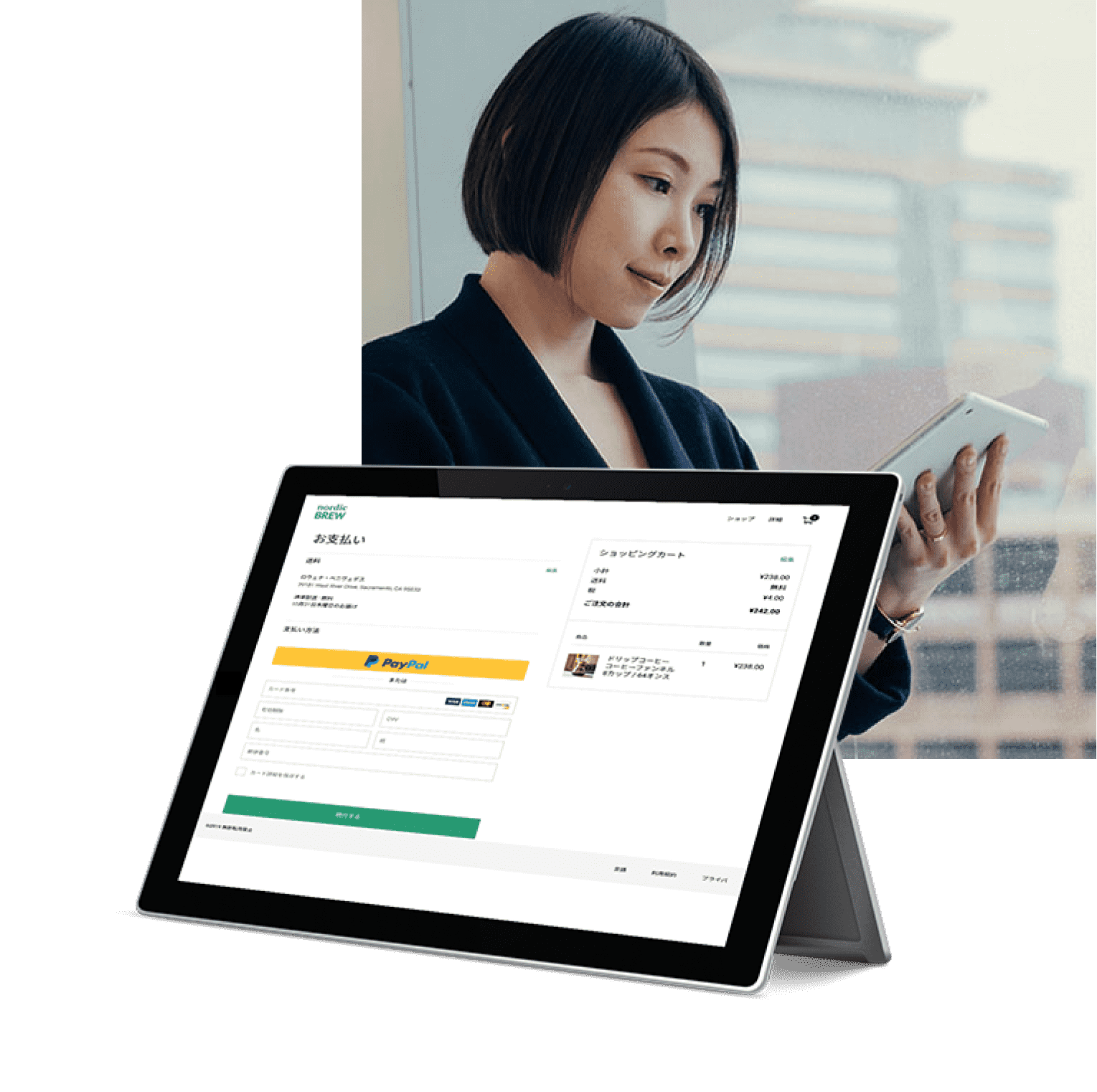

Find new buyers, unlock channels, expand into new markets, and deliver an exceptional checkout experience on various devices

PayPal Complete Payments drives growth, efficiency, and security for enterprise businesses

Help increase conversion rates and lifetime customer value

Adopt full-funnel conversion solutions and optimize checkout across channels.

Gain access to new customers and markets

Reach new groups of active buyers who buy more and buy more often with PayPal.

Adapt to changing market conditions

Keep pace with rapidly changing buying behaviours and complex regulatory environments.

Improve operational efficiency

Build and maintain a modern payments infrastructure that meets your unique system requirements.

75%

of consumers trust PayPal the most due to its consistency and reliability1

37%

of consumers have a higher willingness to buy where PayPal is present2

59%

of users have abandoned a transaction because PayPal wasn’t there3

Enterprise businesses need strategic partners that offer the right mix of expertise, technology, tools, and data to weather uncertainty and achieve their growth potential.

Accept payments

Offer and accept some of the most popular ways to pay.

Learn MoreMake payments

Securely disburse payments around the world.

Learn MoreManage risk

Mitigate existing and future security threats and maintain compliance.

Learn MoreStreamline Operations

Build a payments system that helps to satisfy your unique requirements.

Learn MoreEasy bank settlement that enhances the convenience of settlement and contributes to the expansion of the market

In order to expand the market, users will prepare easy payment methods, and not only existing bank transfers, convenience store / ATM payments and cash on delivery users, but also those who do not have or do not want to use a credit card. It also covers users, improving the payment completion rate and acquiring new users. Here is an example of PIXIV, who has introduced simple bank payments.

Read the case studyContact our sales team

Learn how payments can be leveraged as a catalyst for growth.

Explore developer documentation

See how our flexible and interoperable technology helps to simplify integration.

1 Kelton Research: 2018 Digital Trends Impacting Commerce Study (Among Total Sample who trust PayPal over any other payment method) n=459 Q19. “Why do you trust PayPal the most?”.

2 Ipsos MORI Conjoint Research: Conjoint Simulation Base: (1500) Respondents presented with a variety of transaction scenarios (different variables such as vertical, value, device, familiarity of brand, domesticity of merchant, available payment providers) and asked whether they would be willing to buy, 2018.

3 Ipsos MORI Conjoint Research (US respondents). Methodology: Online survey conducted across seven markets (UK, Germany, Italy, Spain, US, Australia, Brazil) with 1,500 respondents per market/10,500 total respondents (boost in Brazil to ensure 500 PayPal users), including 6,930 PayPal users. Respondents were online shoppers who have made a purchase in the last month, 2018.