How can we help?

Select a PayPal Credit help topic using the menu or use the search bar. If you don’t see what you’re looking for, please contact us.

About PayPal Credit and Our Offers

1. What is PayPal Credit?

If your application is successful, PayPal Credit will be available as a funding source within your PayPal wallet and can be used for purchases in most places where PayPal is accepted. You can make purchases in the same way as you would with a normal credit card, by choosing PayPal Credit as your funding source at checkout.

PayPal Credit will provide you with a monthly statement showing your transactions and detailing the minimum repayment amount. Repayments can be made by monthly direct debit, directly from your PayPal account or by speaking to our customer service agents. For further information on how you can pay your PayPal Credit balance, see the ‘Make a Payment’ section below.

For purchases less than £99.00, interest is charged at your standard variable rate if the full amount is not paid off by the date shown on your statement.

In addition, PayPal Credit lets you access two types of promotional offers:

If you use any of these promotional offers, they will also be detailed on your monthly statement, as well as in the PayPal Credit section of your PayPal account.

2. How are my minimum repayments calculated?

Your minimum repayment amount is calculated based on your purchases, and will include:

If you fail to make minimum repayments on time or in certain other circumstances, PayPal may remove your offer. Please see your Credit Agreement for more details.

Here’s an example of how your minimum repayment is calculated:

| Assuming you had the following transactions on your account: | ||

|---|---|---|

| Instalment offer | Standard balance | 0.00% for 4 month balance |

| £600.00 at 0.00% interest, spread over 6 months | £300.00 | £100.00 |

| The minimum repayment for each component would be calculated as follows: | ||

| £100.00 | 2.00% of £300.00 = £6.00 | 2.00% of £100.00 = £2.00 |

| Your minimum repayment would be £100.00 + £6.00 + £2.00 = £108.00 | ||

3. How does the 0.00% for 4 months offer work?

During the 4 months’ offer period, the 0.00% balance is included in calculating your monthly repayments. You must make your minimum monthly payment or your 0.00% offer may be removed. Any remaining balance due after the offer period or any transactions under £99.00 will be charged interest at your standard variable rate. Please see the Credit Agreement for more details.

4. How do instalment offers with PayPal Credit work?

Instalment offers will always have an interest rate lower than the standard variable rate, and many merchants offer 0.00% instalments with PayPal Credit. If you already have PayPal Credit, you can take advantage of these offers without having to reapply as long as you have enough available credit limit.

It is important that you think about whether you can afford the monthly repayment agreed for any instalment offer. This will be added to your monthly minimum repayment amount and will need to be paid each month.

If you fail to make repayments or in certain other circumstances, PayPal may remove your offer and any outstanding amount will be charged at your standard variable rate. Please see the Credit Agreement for more details.

5. How do the different types of offers on my account interact?

6. How will my payments be allocated if I pay more than the minimum amount due but don’t pay off my full balance each month?

- Toward any monthly payment due on an instalment plan. If you have more than one instalment offer plan, our system will repay the plan with the highest interest rate first followed by the plan(s) at a lower interest rate(s); then

- Toward balances that are subject to the standard variable interest rate (interest and fees on your statement are paid off before any principal); then

- Toward any promotional offer balance: this could be your 0% p.a. interest for 4 months on purchases over £99, that is yet to expire or the balance of an instalment plan; then

- Toward any other balances shown on your statement.

Example:

On your May statement, you have a balance of £750 which comprises the following purchases:

- Sunglasses- £100 @ 0% p.a. for 4 months expiring on 30th June (Promotional Offer 1)

- Camera- £250 @ 9.9% p.a. for 12 months expiring 30th October (Instalment Plan 1)

- Watch- £400 @ 0% p.a. for 4 months expiring on 30th July (Promotional Offer 2)

- £0 balance at standard variable rate

You decide to pay £100, which is more than the minimum payment due but less than the full balance.

From your £100 payment, £32.90 is allocated to the minimum due payment, which leaves £67.10 to be allocated to the above balances as explained here:

- Entire £67.10 allocated to Instalment Plan 1 (the camera at 9.9% p.a.).This is because any amount in excess of the minimum monthly payment due is used to repay that remaining instalment balance. This will NOT reduce monthly instalments due going forward but will shorten the duration of your plan so that it will end sooner.If the balance owed on the camera was £250, we would allocate £22.90 plus £67.10 toward repaying this, resulting in the balance the following month being reduced to £160. You would still be required to make a repayment toward the camera purchase in the following month but the instalment plan would end earlier than 30th October.

- £0 toward your standard variable rate balance as you are not repaying a standard balance for this statement period. A standard balance is made up of standard purchases of goods and services you make using PayPal Credit that are not promotional balances.

A balance of £80 for the purchase of clothes does not qualify for a promotional offer of 0% (less than £99) or an instalment plan so this is a standard variable rate balance. - £0 toward your Promotional Offer 1 (sunglasses)

- £0 toward your Promotional Offer 2 (watch)

How would your repayment be allocated the following month (on your June statement)?

Assume you have not made any new purchases in the last month, your minimum due payment this month is again £32.90. One of your Promotional Offers (sunglasses) is due to expire this month. This means if you do not repay the full amount outstanding on the sunglasses this month, we will start to charge interest on that outstanding amount from next month.

The balance on the sunglasses is £100.

We tell you when your promotional offer is due to expire, and you decide you want to repay the full £100 balance for the camera to avoid interest being charged.

You make a payment of £132.90 (£100 + £32.90) which is more than the minimum due but less than the full balance.

This means after repaying the minimum due amount of £32.90 we will allocate the remaining £100 in the following way:

- Toward your Promotional Offer 1 (the sunglasses) because the interest free period is expiring this month on 30th June which repays this purchase of £100 in full; then

- Any amount remaining after payments towards Promotional Offer 1 (your sunglasses) pays down the remaining Instalment Plan 1 (the camera). This will not reduce monthly instalments due going forward but will shorten the duration of your plan so that it will end sooner; then

- £0 toward your Promotional Offer 2 (watch) unless your camera purchase has been repaid in full (this is because this offer not expire until 30 July).

7. Can I choose which purchases to pay off first?

This means if you have any promotional offer purchases (0% p.a. interest for 4 months on purchases over £99) and are also repaying an instalment plan(s), our system will always allocate repayments over the minimum monthly payment to the instalment plan(s) with a higher rate of interest first. The exception is where your 0% p.a. for 4 months offer is going to expire in that month, in which case we will apply your repayment over the minimum monthly payment to that 0% for 4 months offer before the instalment plan.

However, this is to your advantage as it means you pay less interest overall across all of your PayPal purchases.

8. How can I avoid paying interest on my promotional offers?

If your PayPal Credit account balance is comprised entirely of purchases at a 0% p.a. for 4 month Promotional Offer, your payments will be allocated to those balance based on the date order in which the promotional offers expire.

Information about any active Promotional Offers and Instalment Plans (such as remaining balances and the expiry dates) can be obtained at any time, by logging into your account on PayPal.com or in the PayPal mobile app.

We will also email you at least 14 days before your promotional offer interest free period is due to expire.

Getting Started

1. How do I apply?

Before you apply, please make sure you:

- Are a UK resident aged 18 years or older

- Have a good credit history

- Have not recently been declared bankrupt

- Are employed and have an income greater than £7,500 per year

2. What if I don’t have a PayPal account?

3. How long does it take to apply for/receive PayPal Credit?

4. I have a business account. How can I sign up for PayPal Credit?

5. How much will my credit limit be?

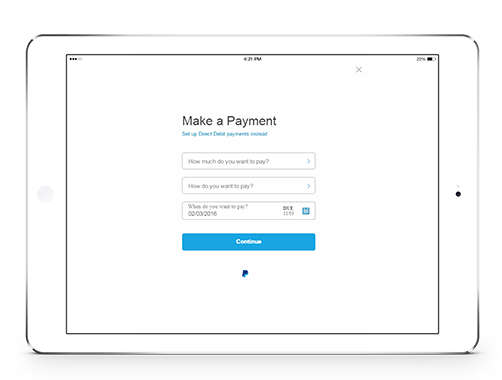

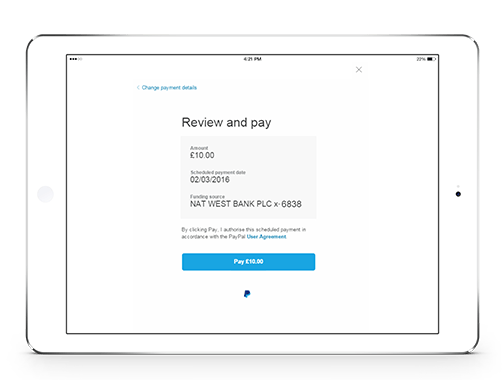

Make a Payment

1. How do I make a payment?

You can also make a payment by calling PayPal Customer Service on 0800 368 7155. Through customer services, we can accept payment via any debit card, even those not linked to your PayPal account.

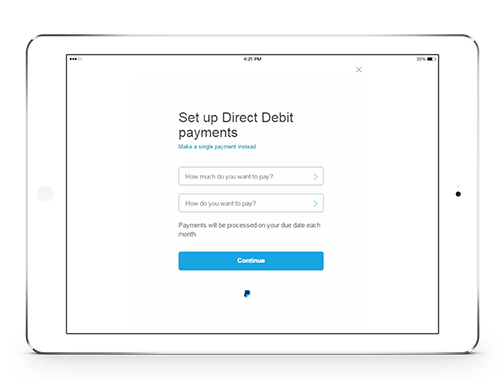

2. How do I set up a direct debit?

- Log into your PayPal account and select PayPal Credit

- Select “Set up a direct debit payment”

- Choose how much you want to pay each month and from which bank account.

To add a new bank account to your PayPal account:

- Log in to your account

- Select “wallet”

- Choose “add a bank account”.

- Once a bank is added, you can make payments directly to your PayPal Credit account or set up a direct debit.

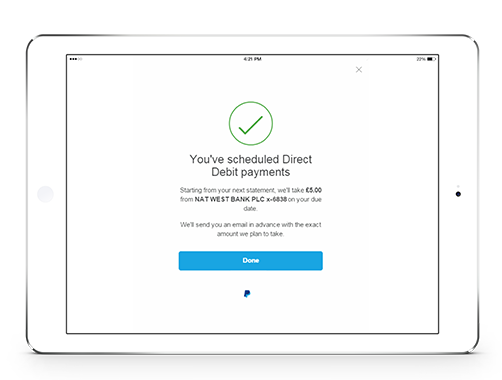

3. When will my Direct Debit start?

- the minimum amount due

- the last statement balance

- any "other amount" in between each month.

- If I make changes to my direct debit how long will it take to implement?

If you make changes to your direct debit it can take up to a month to implement which means you may need to add a manual payment in month to ensure you are covered and the direct debit changes will be implemented the following month.

If you choose to pay any "other amount", it is important to note that the Direct Debit will not start on your next due date. It is likely to start the following month. Please be sure to make a single payment the month you set it up to avoid missing any payment due. We will tell you when you’re setting up the Direct Debit exactly when it will take effect from.

4. I just opened up a PayPal Credit account, when is my payment due?

5. Can I setup payment due reminder alerts?

6. How long does it take for payments to reflect on my account?

7. Can I use my credit card to make a payment on my PayPal Credit account?

8. Can I use my credit card to set up a direct debit to make payments on my PayPal Credit account?

9. What if I can’t pay?

Citizens Advice:

- England and Wales www.citizensadvice.org.uk

- Northern Ireland (Advice NI) www.adviceni.net

- Scotland (Citizens Advice Scotland) www.cas.org.uk

- Payplan: call 0800 917 7823 or visit www.payplan.com

- StepChange Debt Charity: call 0800 138 1111 or visit www.stepchange.org

- National Debtline: call 0808 808 4000 or visit www.nationaldebtline.org/

10. I’ve been using PayPal for a while now. How can I find out when my PayPal Credit payment is due?

Manage your account

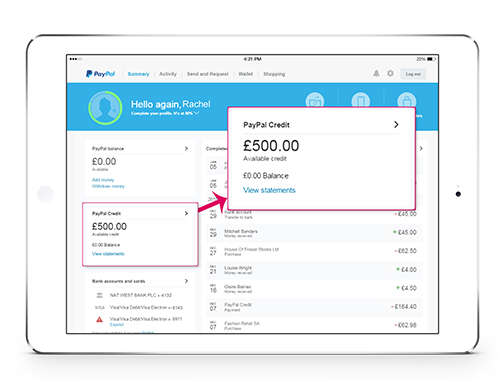

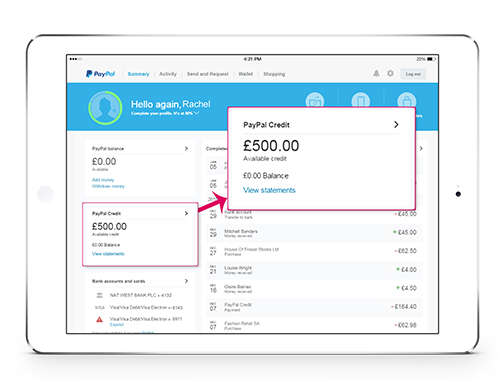

1. How do I manage my account?

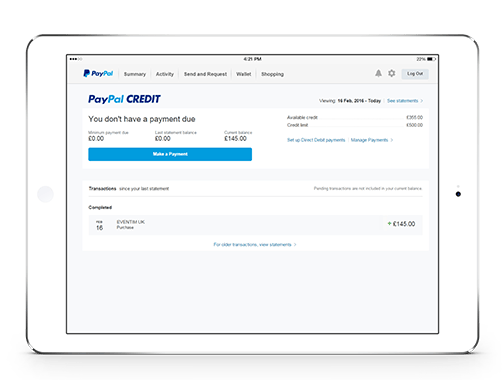

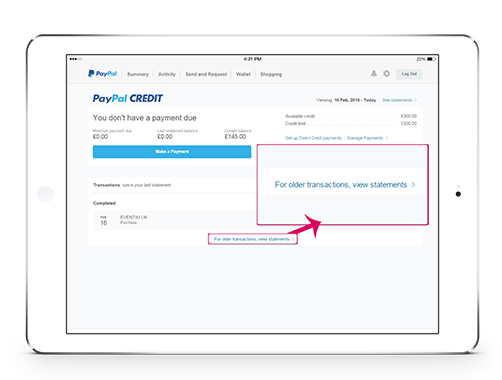

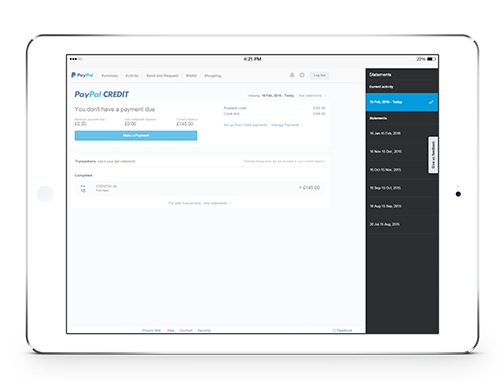

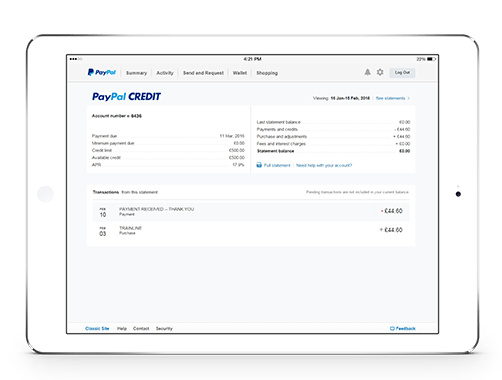

2. Where can I find my statements?

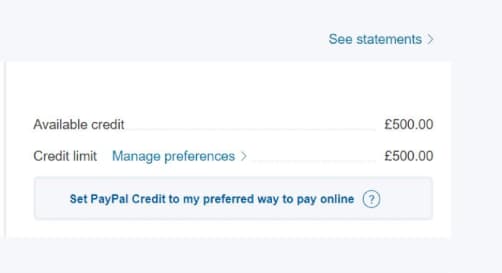

- Login to your PayPal account on your desktop and select PayPal Credit

- Select "See statements"

- You can view all statements online as well as download them as PDFs

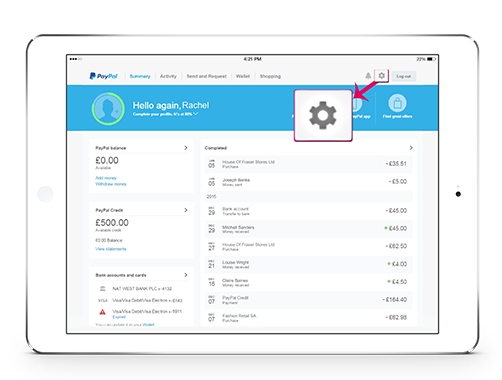

3. How can I update my contact details?

- Login to your PayPal account

- Select the “Settings” icon

- Update your contact details

4. How do I close my PayPal Credit account?

To close your account, you can call our PayPal Credit customer service team on 0800 368 7155.

Using PayPal Credit

1. Where can I use PayPal Credit?

We also offer instalment offers at select merchants.

2. How do I select PayPal Credit as my funding source?

- At checkout, choose to pay with PayPal

- Simply change the payment source to PayPal Credit

- Confirm and Pay

3. Will I receive alerts on my mobile phone for transaction made on my account?

4. Are there any businesses or types of goods for which I cannot use PayPal Credit?

Excluded categories include merchants selling adult content, stored value cards, and gambling.

5. Can I transfer money to family and friends or my bank account using my PayPal Credit?

6. Can I get cash with my credit account?

7. Can I use my PayPal Credit for “Invoice" or "Money Request”?

8. Does PayPal Credit protect me from unauthorised charges?

Here's how to report an unauthorised transaction:

- Log in to your PayPal account.

- Under 'More about your account', click Resolve a problem in our Resolution Centre.

- Click Dispute a transaction

- Select the item you wish to dispute, Click "Continue", and follow the rest of the instructions provided to submit your dispute.

9. I have upgraded to a business account and now I can no longer see all of my PayPal Credit information/ functions, why is this case?

- Log in

- Select “PayPal Credit”

Fees

1. Are there any fees I should be aware of?

If you’re late with a payment, PayPal may charge you a late payment fee of £12.00.

Returned Payments

You may be charged a return payment fee of £12.00 if you have insufficient funds to cover the payment.

Statements (Paper Copy)

We also charge a fee of £5.00 if you request that we send you a printed copy of a previous statement. All statements are available to download or view online within the PayPal Credit section of your PayPal account.

For more information on how these fees apply, please refer to the Outline of Credit, the Standard European Consumer Credit Information document or the Credit Agreement.

2. Is there an annual fee?

Persistent debt

1. What is persistent debt?

2. I’ve received a letter stating I’ve paid more in interest, fees and charges than principal over the last 18 months. What does this mean?

3. How can I increase my payments?

You might consider setting up a Direct Debit, which is an easy way to pay the amount you choose automatically rather than having to make them manually yourself each month. To set up a Direct Debit or change your existing Direct Debit, log in to your PayPal account.

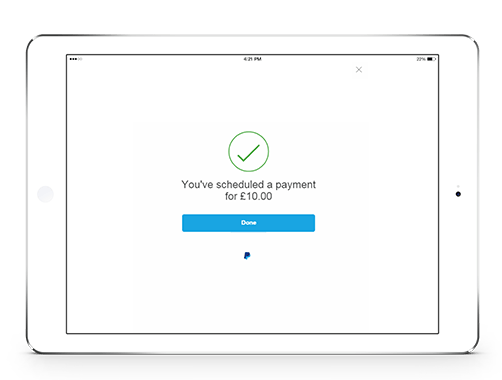

Alternatively, you can make or schedule an additional payment in your account by following the link above and clicking the “Make a Payment” button. You can also make a payment by calling 0800 368 7155.

4. What do I do if I can’t afford to increase my minimum payment?

5. Where else can I go for financial help and support?

Additionally, the following organisations may be able to help:

AdviceUK: www.adviceuk.org.uk/

Citizens Advice: www.citizensadvice.org.uk/

National Debtline: www.nationaldebtline.org/

StepChange Debt Charity: www.stepchange.org/

Cross Currency

1. Which currencies does PayPal Credit support?

2. What exchange rate is charged?

3. Can I still get the 0.00% for 4 months offer and instalment offers with transactions in non-GBP currencies?

(Occasionally, exchange rates may fluctuate and impact whether a non-GBP transaction qualifies for a promotional offer. If you believe you should have qualified for a promotion – please call our Customer Services.)

4. Am I still protected by Buyer Protection if I make a purchase in non-GBP currencies?

5. What happens if my purchased item is returned?

6. How will the transaction be displayed at checkout?

7. How will a non-GBP transaction appear on my statement?

Credit Limit Increases

1. How do I increase my credit limit?

2. Can I apply for a credit limit increase?

3. What are the eligibility criteria for a credit limit increase?

- Have been a PayPal Credit customer for at least 6 months

- Have not been in arrears in the last 6 months

- Have transacted with PayPal Credit in the last 6 months.

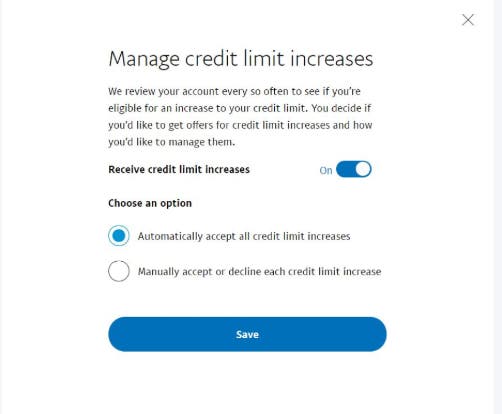

4. How do I change my credit limit preferences?

5. My credit limit has increased automatically. How can I reduce this back to its original limit?

6. If I change my preferences when I have a pending credit limit increase offer, will it apply to the pending offer?

7. What options are available to me for credit limit increases?

- Automatically accept all credit limit increases. This means any future credit limit increase that is offered will be applied automatically to your account.

- Manually accept or decline each credit limit increase. This means that when an offer becomes available to you, you will need to log in to your account and accept or decline the offer yourself.

- Turn off credit limit increases. This means you will not be offered a credit limit increase even when you become eligible.

8. Can I increase my credit limit increase before the offer expires?

9. My credit limit increase offer has expired. Can I still get it?

Credit Limit Decreases

1. Can I keep my existing limit and opt out of the credit limit decrease?

2. Can I choose a different credit limit to the one I received?

3. Can I choose a different date the credit limit decrease occurs?

4. Is a credit check completed as part of my credit limit decrease?

5. Will this credit limit decrease affect my credit score?

The identities of the CRAs, and the ways in which they use and share personal information, are explained in more detail at:

www.transunion.co.uk/crain

www.equifax.co.uk/crain

www.experian.co.uk/crain

Other FAQs

1. I have been declined for PayPal Credit. Why?

If you want to re-apply, you will be able to 35 days after your last application.

2. What is a Representative APR and what is the Representative APR for PayPal?

The Representative APR is the rate that at least 51% of those accepted for PayPal Credit will get. That means almost half of those customers who are approved may not receive the advertised Representative APR and will receive a different rate.

If you are approved for PayPal Credit, the rate we give you will depend on your individual circumstances. [Your actual APR and standard rate of interest is set out in your pre-contract information and Credit Agreement.]

Sometimes your purchase will benefit from a promotional offer with a lower rate of interest. Your standard rate of interest will not apply to transactions charged at a lower interest rate during the promotional offer period. See your Credit Agreement for more details.

We may increase your standard interest rate by giving you at least 30 days’ notice. For more information on when we would do this please see your Credit Agreement.

3. What does subject to approval mean?

4. Is there a cooling off period if I want to close my PayPal Credit account?

5. What currency does PayPal Credit Support?

6. I accidently used PayPal Credit for a purchase how can I clear my purchase.

7. Does PayPal Buyer Protection apply to my PayPal Credit purchases?

For full information on eligibility, see our User Agreement.

8. How can I use PayPal Credit on Curve?

To get set up, you'll first need a bank account, an eligible payment card or PayPal Credit – attached to your PayPal wallet (AMEX and VISA cards are not eligible). Then you'll be able to switch between paying with your PayPal balance, bank or any of these funding sources at any time from the level of the PayPal app. You can find the steps to add your account here.

You'll also be able to pay using both the physical Curve card and your smartphone's digital wallet (e.g. Apple Pay, Google Pay and Samsung Pay).

9. Can I set PayPal Credit as preferred within the Curve app when linking PayPal to Curve?

10. Can I use my Curve card to repay PayPal Credit?

11. Do I get Section 75 Protection on PayPal Credit transactions through Curve?

Contact Us

1. How can I contact you if I have any further questions?

Hours of service:

Monday to Sunday 8am to 6.30pm (GMT)

If you’re calling from outside the UK, call 0044 800 368 7155

Fax: 020 8080 6518

Alternatively, if you’re an existing customer you can use our secure message centre for all account related enquiries by logging into your PayPal Account.

Representative Example:

Representative

23.90% APR (variable)

Purchase interest rate

23.90% p.a. (variable)

Assumed Credit limit

£1,200.00

Your actual interest rate and credit limit may vary depending on your individual circumstances.

Subject to status. Terms and conditions apply. UK residents only.

Apply for PayPal Credit now

Apply Now*Credit subject to status. Terms and conditions apply. UK residents only. PayPal Credit is trading name of PayPal UK Ltd.